What Is the Most Common Mistake Made on Taxes?

When tax season rolls around, most people worry about making a big mistake, misreporting income, forgetting a deduction, or typing in the wrong Social Security number. But by far, the most common mistake isn’t a math error or a missing form. It’s simply this: failing to report all your income. Whether it’s a side hustle, freelance gig, a cashed-out savings bond, or a forgotten 1099 from a previous employer, any unreported income can trigger an automatic IRS notice, and often, a bill with added penalties and interest.

The tricky part? This kind of mistake often isn’t intentional. Many taxpayers assume if they didn’t receive a W-2 or major payout, it doesn’t need to be reported. But the IRS receives copies of most income documents you get—like 1099-NEC, 1099-K, or even 1099-INT. If you skip reporting just one of them, the system will flag the mismatch. You might not hear about it for months, but when the IRS does catch it, they’ll send a notice, and the clock starts ticking on the added fees. Even small amounts, like $50 in interest, shouldn’t be overlooked.

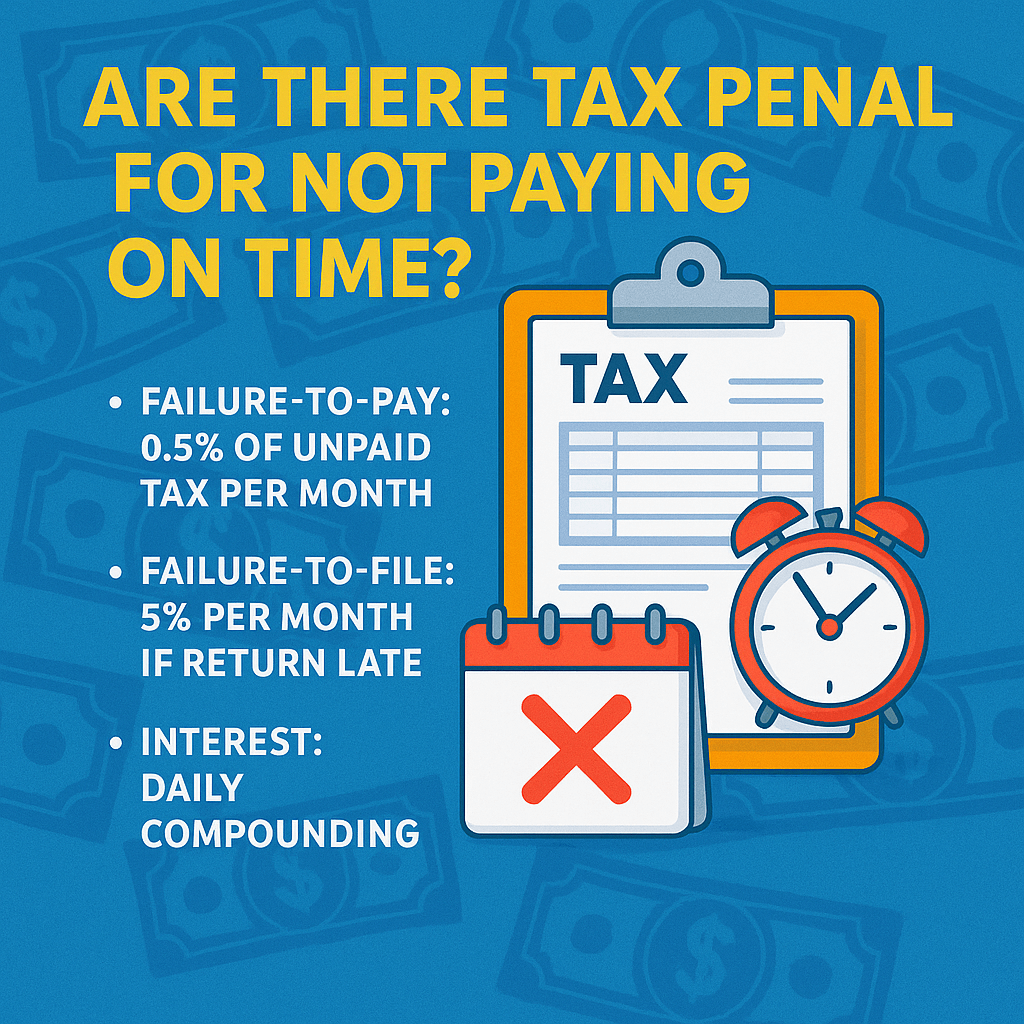

Of course, there are plenty of other errors too: entering the wrong filing status, claiming ineligible dependents, forgetting to sign your return, or miscalculating deductions and credits. Some of these errors can delay your refund or reduce your refund amount, while others might result in extra tax due or additional scrutiny. While tax software helps reduce these issues, it’s only as good as the information you enter. If your situation involves multiple income streams, dependents, business write-offs, or changes in filing status, consider having a tax lawyer review your return.

In the end, accuracy and thoroughness matter more than speed. Double-check your documents, match every tax form to your return, and don’t assume the IRS won’t notice the small stuff. Taking the time to be precise can save you from stress, audits, and unwanted surprises later on. And if you’re not sure, always ask, because guessing with the IRS is rarely a winning strategy.