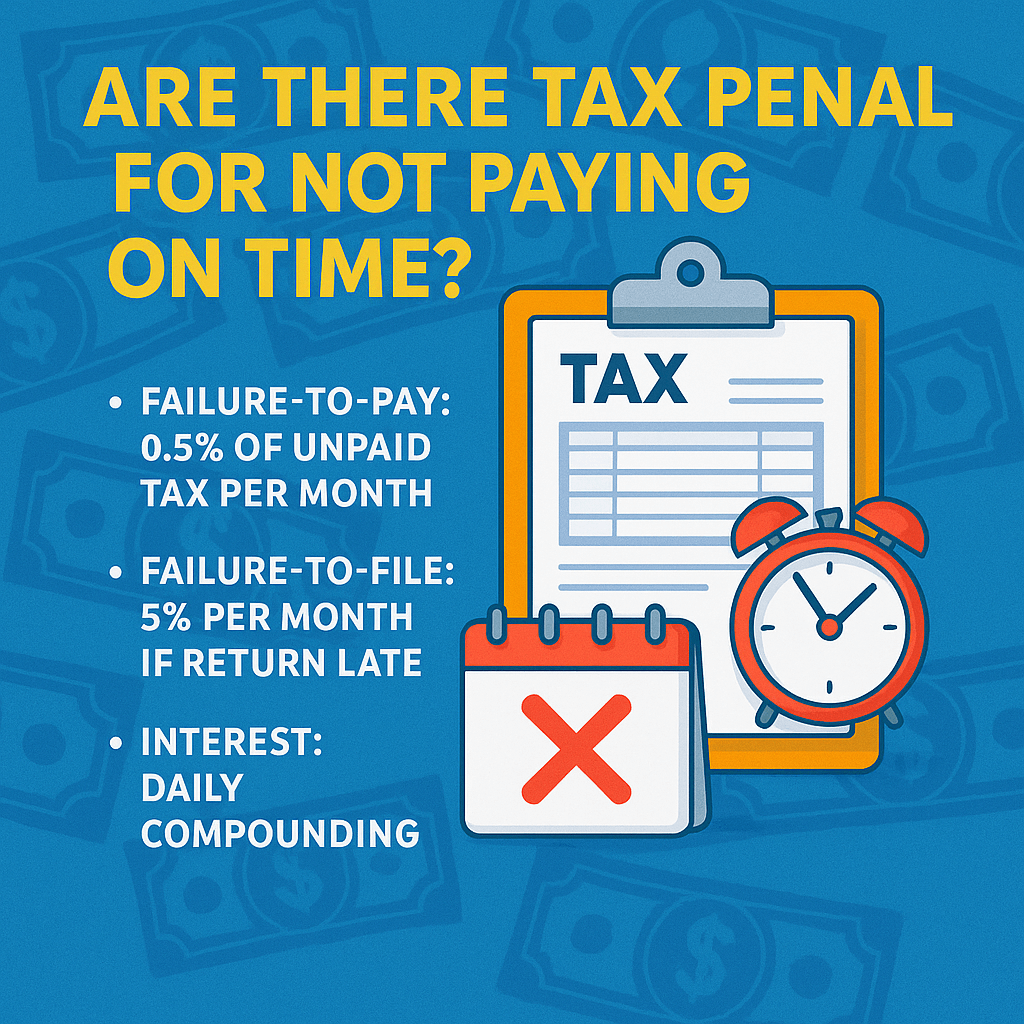

Are There Tax Penalties for Not Paying on Time?

Yes—if you don’t pay your taxes on time, the IRS will hit you with penalties, and they start adding up immediately. Just like missing a credit card payment, being late on taxes triggers financial consequences. And the longer you delay, the more it costs.

The most common penalty is the Failure-to-Pay Penalty. It typically adds 0.5% of your unpaid taxes each month, up to a maximum of 25%. On top of that, interest accrues daily on both the balance and the penalties. If you also failed to file your return, the Failure-to-File Penalty kicks in, which is even steeper—5% per month, up to 25% of what you owe.

Quick Breakdown of Penalties:

- Failure-to-Pay: 0.5% of unpaid tax per month (max 25%)

- Failure-to-File: 5% per month if return is late (max 25%)

- Underpayment Penalties: If you didn’t pay enough during the year

- Interest: Compounded daily on both taxes and penalties

It may not seem like much at first, but these charges grow quickly. A small delay can turn into a much larger bill. If you can’t pay in full, the best move is to file your return anyway and set up a payment plan with the IRS. Doing so stops the worst penalties and shows you’re making an effort.There’s even a chance to request Penalty Abatement if you’ve had a good filing history or faced a genuine hardship. The key is to act early—because tax penalties don’t go away on their own. For the best chances of success, it is recommended to use a IRS tax debt attorney.