National Debt Relief Review: Is It the Right Solution for Your Financial Woes?

Navigating complex tax issues can be overwhelming, especially when you’re dealing with the IRS. Whether it’s a tax dispute, an audit, or penalties, having professional guidance can make all the difference. Finding a tax debt lawyer who can effectively handle IRS-related problems is crucial to resolving your tax matters quickly and efficiently.

In this guide, we’ll explore how a tax lawyer can help you manage your tax issues and discuss the three major IRS complaints that taxpayers frequently face.

Why You Need a Tax Lawyer Near You

Dealing with the IRS is not something you should face alone, especially if you have complex tax concerns. A tax lawyer can offer the legal expertise needed to navigate IRS procedures and advocate on your behalf. Whether you’re facing penalties, a tax audit, or dealing with unpaid taxes, a tax lawyer is equipped to help resolve the situation.

Having local legal support means that the lawyer is familiar with state-specific tax laws in addition to federal regulations, ensuring you receive well-rounded advice tailored to your situation. Moreover, a tax lawyer can negotiate with the IRS, represent you in court, and help reduce or eliminate potential penalties.

The Three Major IRS Complaints

Taxpayers often face various challenges when dealing with the IRS, but there are three major complaints that are the most common:

1. Incorrect Tax Assessments

One of the most frequent IRS complaints involves incorrect tax assessments. Many taxpayers receive notices from the IRS claiming they owe additional taxes due to discrepancies in their filings. These errors can be caused by miscalculations, missing forms, or misunderstandings of the tax code.

An experienced tax lawyer can help resolve these issues by reviewing your tax filings and providing legal support in correcting the assessments. Whether it’s providing documentation or disputing the IRS’s claim, a tax lawyer can ensure that the issue is handled professionally and effectively.

2. Unfair Penalties and Interest

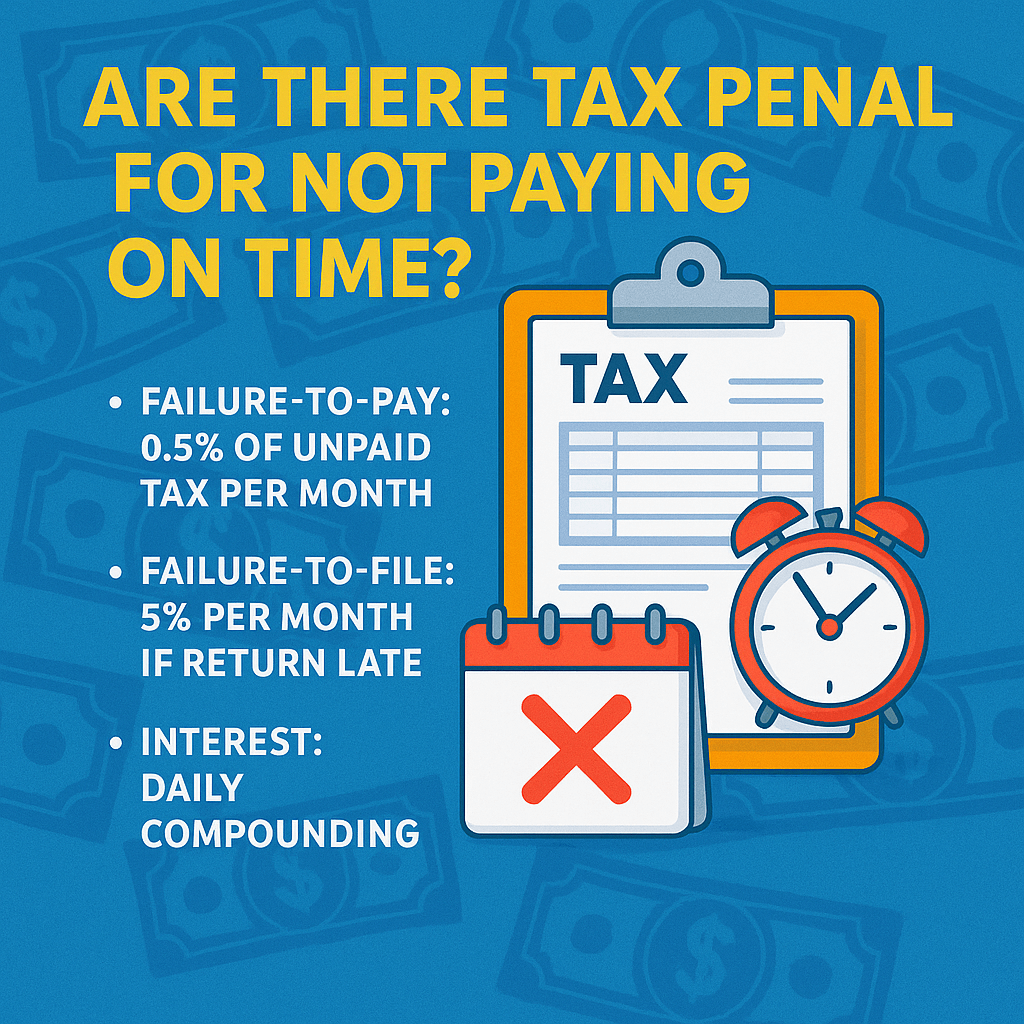

Another common complaint involves the penalties and interest imposed by the IRS on late or underpaid taxes. These penalties can quickly add up, making it harder to pay off the original tax amount. In some cases, the penalties may be unjustified or the result of an honest mistake.

If you’re facing penalties you believe are excessive, a tax lawyer can help by negotiating with the IRS to reduce or eliminate them. By filing an appeal or seeking penalty abatement, a lawyer can work to minimize the financial burden.

3. Audits and Inconsistent Communication

The prospect of an IRS audit can be intimidating, and many taxpayers feel that the communication from the IRS during this process is unclear or inconsistent. Misunderstandings about what the IRS requires during an audit can lead to prolonged investigations and increased stress for taxpayers.

Having a tax lawyer by your side during an audit is invaluable. Your lawyer can communicate directly with the IRS on your behalf, ensuring that all required documents are submitted, and any inconsistencies are cleared up as efficiently as possible.

How a Tax Lawyer Can Help with IRS Complaints

A tax lawyer near you is your best resource for handling the three major IRS complaints effectively. Not only do they have the legal knowledge to dispute IRS errors, but they also have experience in negotiating with the IRS to resolve issues before they escalate into more significant problems.

For incorrect assessments, they can help gather the necessary documents to prove your case. When dealing with penalties, they can appeal for reductions or exemptions. And during audits, they can manage the entire process, ensuring that the IRS follows the proper procedures and that your rights are protected.

Conclusion

If you’re facing tax issues and looking for a tax lawyer, it’s essential to find one with experience in handling the three major IRS complaints—incorrect tax assessments, unfair penalties, and audits. With the right legal support, you can resolve your tax issues efficiently and minimize your financial burden.